HARRISBURG -- The Pennsylvania Department of Revenue has been offering tax amnesty to people who have failed to pay their taxes in recent years.

Newswatch 16 told you about a 93-year-old woman from Schuylkill County who said tax collection efforts against her were heavy handed.

The Pennsylvania Department of Revenue has dropped its case against her.

But since our report last week, more people have come forward claiming the state is pressuring them to pay taxes they do not owe.

A Department of Revenue spokesman says most people it contacts about the tax amnesty program do owe money, but more people who say they don't owe a cent claim the people trying to collect the money are not only wrong, they're pushy, and don't take no for an answer.

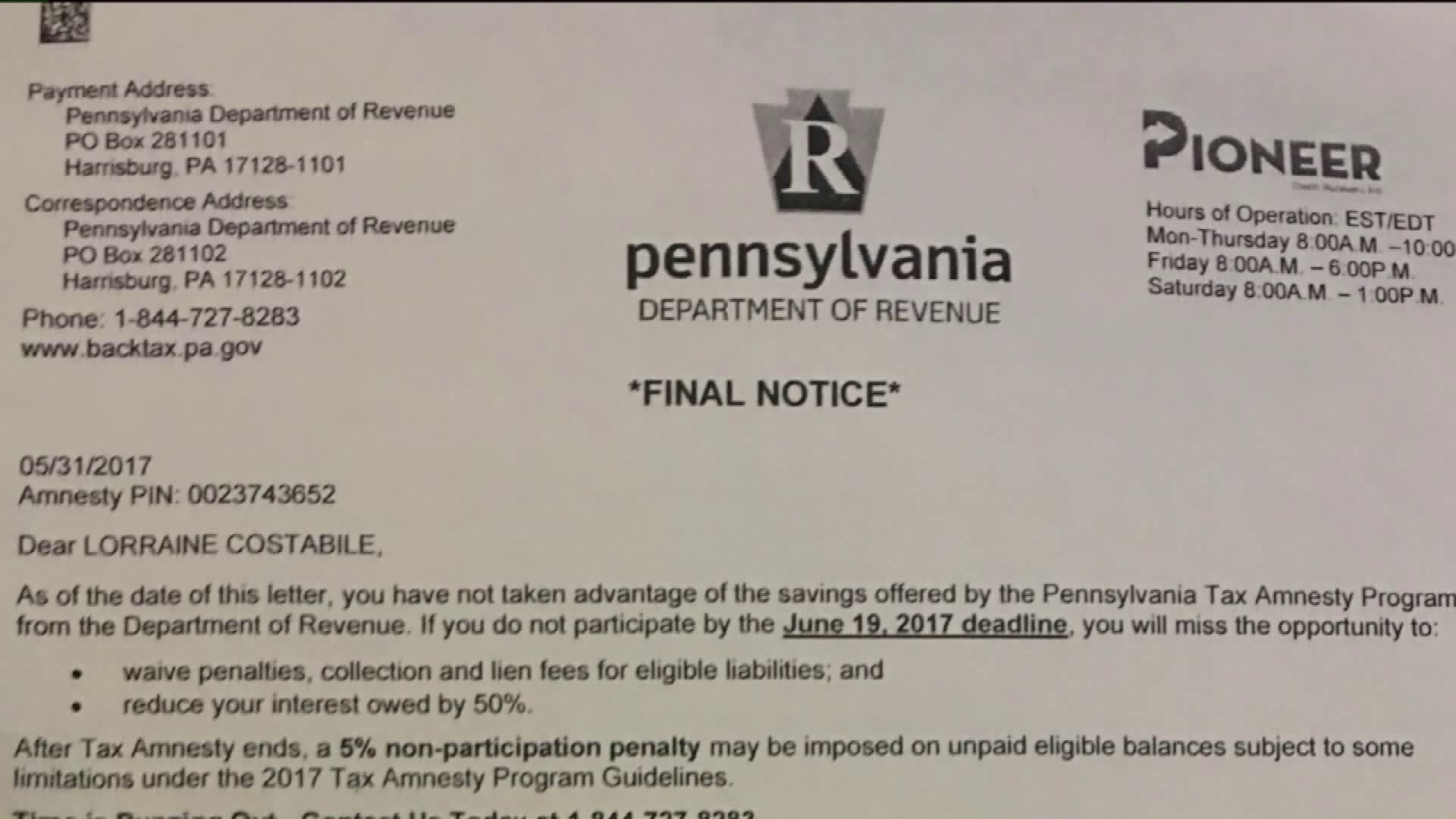

Carroll Winans of Mahanoy City and Lorraine Costabile of Hazleton both received letters from the state Department of Revenue titled "final notice."

Winans' letter warns the state will tack on a $30 penalty if she doesn't pay $114 in income taxes from 1987.

"How would I owe taxes when I was two years old? I was two years old," Winans said.

Costabile's letter doesn't say how much she owes. She's 69, living on a fixed income, and the letter warns she failed to pay an inheritance tax in 2000, the year her husband died.

"My husband's been dead almost 18 years. I said, 'This is ridiculous!'"

Costabile says she owes nothing as there is no inheritance tax for the death of a spouse.

Since our Newswatch 16 investigation last week, advocates for seniors tell us they fear older Pennsylvanians receiving these letters will be too worried to challenge the Department of Revenue and pay the bills even if they don't owe money.

"Why are they sending me this? It's a rip-off," said Costabile.

Both Lorraine Costabile and Carroll Winans called the state to complain. They say their concerns were brushed off by Department of Revenue workers who answered their calls.

"She said, 'You owe a substantial amount of taxes,'" Costabile explained.

"I asked him how I owe taxes and the guy was starting to laugh when I told him I was two years old," said Winans.

For Winans, this is no laughing matter. She's moving from Mahanoy City to Pottsville hoping to find work. She fears that won't be easy if the Pennsylvania Department of Revenue still lists her as owing taxes.

"It could affect my credit score, and I don't want that to happen in case if I need it for the future. And if I'm applying for a job, it could show that I still owe taxes."

The state Department of Revenue emailed Newswatch 16, "The law requires the department to mail notices to anyone who might be eligible for amnesty."

The email added anyone questioning the accuracy of the notices should call or email the department.

The department can be reached at 1-844-PA-STATE (1-844-727-8283).

For more information, visit revenue.pa.gov/taxamnesty